At the forefront of property financing in Costa Rica, GapInvestments.com stands as a beacon for…

Explore Home Financing GAP Investments in Costa Rica Today.

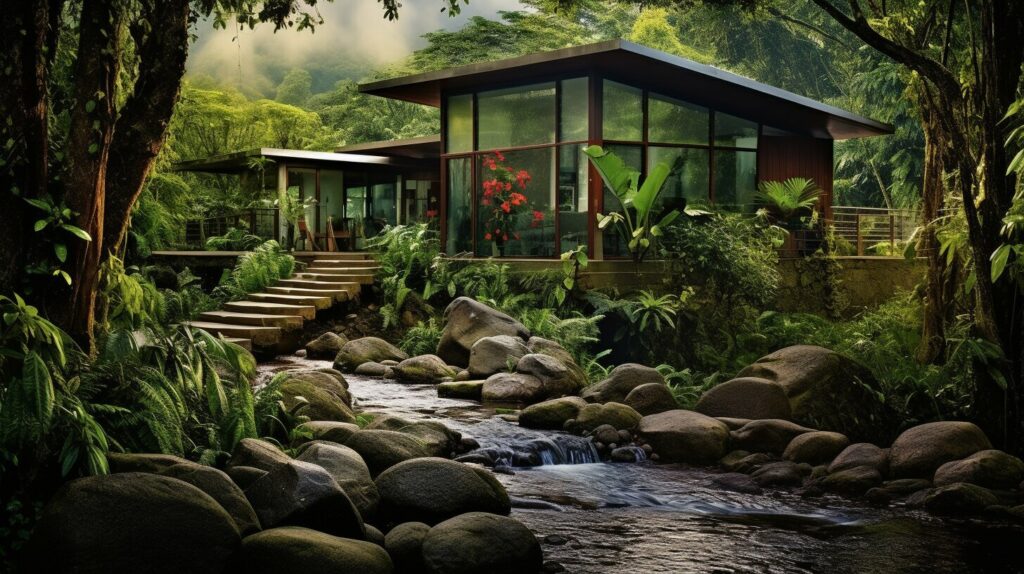

Home financing GAP investments in Costa Rica offer private investors a lucrative opportunity to earn great returns while optimizing their investment portfolio. These investments are a flexible and versatile financing option for real estate investments, providing borrowers with the ability to use their property as collateral to secure a loan for renovations, property development, or additional real estate purchases. With competitive interest rates and flexible term options, GAP loans in Costa Rica are an attractive alternative to traditional financing options.

GAP loans are particularly beneficial for those who may not have access to traditional bank financing or need funds quickly. This makes them a reliable and efficient financing option, especially for real estate development, renovations, and additional property purchases in Costa Rica. The short-term financing options, ranging from 6 months to 3 years, allow borrowers to pursue their investment goals within a reasonable time frame.

The application and approval process for GAP loans in Costa Rica is efficient, with borrowers being able to receive funds in a matter of days once approved. These loans can be used for various purposes, including bridge financing, renovation financing, and property development. It is crucial to work with reputable GAP financing providers in Costa Rica to ensure transparent and reliable terms and conditions.

Key Takeaways:

- Home financing GAP investments in Costa Rica offer private investors a lucrative opportunity to earn great returns.

- GAP loans in Costa Rica are a flexible and versatile financing option for real estate investments.

- Borrowers can use their property as collateral to secure funds for renovations, property development, or additional real estate purchases.

- GAP loans provide competitive interest rates and flexible term options.

- They are a reliable and efficient financing option, particularly for those without access to traditional bank financing or in need of quick funds.

For more information on home financing GAP investments in Costa Rica, please contact our experts at [contact information].

Understanding GAP Investments in Costa Rica

GAP investments in Costa Rica provide borrowers with a flexible and versatile financing option for real estate investments, allowing them to leverage their properties for renovations, development, or additional purchases. These loans offer competitive interest rates and flexible term options, making them an attractive alternative to traditional financing options. Whether you’re looking to renovate your existing property, embark on a new development project, or expand your real estate portfolio, GAP loans can provide the funds you need.

Unlike traditional bank financing, GAP loans are accessible to those who may not meet the strict requirements of conventional lenders or need funds quickly. This makes them particularly suitable for real estate development in Costa Rica, where borrowers can obtain short-term financing ranging from 6 months to 3 years. The application and approval process for GAP loans is typically efficient, with borrowers receiving funds in a matter of days. This allows them to seize investment opportunities promptly and pursue their real estate goals without delay.

When considering GAP financing in Costa Rica, it’s essential to work with reputable lenders who offer transparent and reliable terms and conditions. By partnering with experienced and trustworthy financing providers, borrowers can navigate the financing process with confidence. Interest rates for GAP loans in Costa Rica can vary depending on the lending institution and the borrower’s creditworthiness. Therefore, it’s crucial to research different lenders, compare loan terms, and assess customer reviews to find the best option for your real estate investment needs.

Benefits of GAP Investments in Costa Rica

- Competitive interest rates

- Flexible terms

- Quick access to funds

- Opportunity for property development

- Potential for high returns

Overall, GAP investments in Costa Rica offer borrowers a valuable financing solution for their real estate ventures. By utilizing the equity in their properties, borrowers can access the funds necessary to pursue renovations, development projects, or additional property purchases. The flexibility, efficiency, and potential returns make GAP loans an attractive option for investors in the Costa Rican real estate market.

| Loan Term | Interest Rate | Purpose |

|---|---|---|

| 6 months | 5.25% | Bridge financing for property purchase |

| 2 years | 7.5% | Renovation funding |

| 3 years | 6.75% | Property development project |

Table: Representative GAP Loan Terms in Costa Rica

Advantages and Process of GAP Financing in Costa Rica

GAP financing in Costa Rica offers borrowers numerous advantages, including competitive interest rates, a streamlined application process, and quick access to funds for real estate purposes. This financing option is a flexible and versatile solution for those seeking to invest in property development, renovations, or additional real estate purchases. Whether you are an individual investor, a real estate developer, or a property owner looking to enhance your current asset, GAP loans can provide the financial support you need.

One of the key benefits of GAP financing is its competitive interest rates. Lenders in Costa Rica offer attractive terms to borrowers, allowing them to secure funding at rates that are often more favorable than traditional bank loans. This can result in significant savings over the life of the loan, making GAP financing an appealing option for many investors.

The application and approval process for GAP loans in Costa Rica is also streamlined, ensuring efficiency and convenience for borrowers. With simplified paperwork and minimal documentation requirements, borrowers can save time and energy. Once approved, funds can be disbursed in a matter of days, enabling investors to seize opportunities quickly.

GAP loans can be used for a variety of purposes related to real estate investment in Costa Rica. Whether you’re looking to bridge financing for a new property purchase, fund renovations, or undertake property development projects, GAP financing can provide the necessary capital. The terms of GAP loans generally range from 6 months to 3 years, offering flexibility to borrowers based on their specific needs and investment timeline.

To ensure a reliable and transparent financing experience, it is crucial to work with reputable GAP financing providers in Costa Rica. Research and consider factors such as the lender’s reputation, experience, customer reviews, and specific loan terms and conditions. By choosing a trusted partner, borrowers can have peace of mind and confidence in their financing decision.

| GAP Financing Advantages | Process |

|---|---|

| Competitive interest rates | Streamlined application process |

| Flexible terms for real estate investments | Quick access to funds |

| Can be used for various purposes | Efficient approval and disbursement |

| Transparent and reliable terms and conditions |

Conclusion

Home financing GAP investments in Costa Rica offer private investors a lucrative opportunity to optimize their investment portfolios, with competitive interest rates, flexible terms, and a range of real estate development possibilities. Gap loans in Costa Rica provide borrowers with the flexibility and versatility to use their property as collateral, securing funds for renovations, property development, or additional real estate purchases.

These loans offer attractive alternatives to traditional financing options, especially for those who may not have access to traditional bank financing or require funds quickly. With short-term financing options ranging from 6 months to 3 years, borrowers can pursue their real estate investment goals effectively.

Working with reputable gap financing providers in Costa Rica is essential to ensure transparent and reliable terms and conditions. By doing so, borrowers can secure loans with competitive interest rates and navigate the efficient application and approval process. Once approved, borrowers can receive funds in a matter of days, enabling them to seize real estate investment opportunities swiftly.

Whether it’s bridge financing, property renovations, or real estate development, gap loans in Costa Rica offer a reliable and efficient way to turn investment goals into reality. With the potential for great returns, private investors should explore this emerging market and consider including home financing GAP investments in Costa Rica in their investment portfolios.

FAQ

Q: What is a GAP loan in Costa Rica?

A: A GAP loan in Costa Rica is a flexible and versatile financing option for real estate investments. Borrowers can use their property as collateral to secure a loan for renovations, property development, or additional real estate purchases.

Q: How do GAP loans in Costa Rica compare to traditional financing options?

A: GAP loans in Costa Rica offer competitive interest rates and flexible term options, making them an attractive alternative to traditional financing options. They are a reliable and efficient financing option for those who may not have access to traditional bank financing or need funds quickly.

Q: What can GAP loans in Costa Rica be used for?

A: GAP loans in Costa Rica can be used for various purposes, such as bridge financing for the purchase of a new property, renovation financing, and property development.

Q: How long is the repayment term for a GAP loan in Costa Rica?

A: The repayment term for a GAP loan in Costa Rica typically ranges from 6 months to 3 years.

Q: How quickly can funds be received with a GAP loan in Costa Rica?

A: Once approved, borrowers can receive funds with a GAP loan in Costa Rica in a matter of days.

Q: What should borrowers consider when choosing a GAP financing provider in Costa Rica?

A: When choosing a GAP financing provider in Costa Rica, borrowers should consider the lender’s reputation, experience, customer reviews, and specific loan terms and conditions.

Q: Can GAP loans in Costa Rica be used for property development?

A: Yes, GAP loans in Costa Rica can be used for property development, providing the needed funds for renovations, expansions, or other real estate development projects.

Q: What factors can affect the interest rates for GAP loans in Costa Rica?

A: The interest rates for GAP loans in Costa Rica can vary depending on the lending institution and the borrower’s creditworthiness.