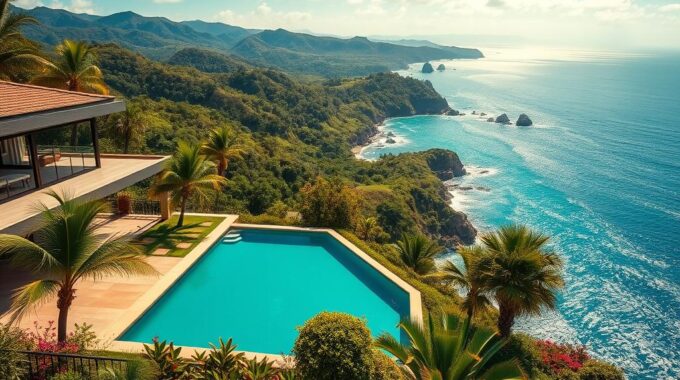

For property owners in Costa Rica, the value of their real estate is more than…

Unlock Costa Rica Property Investments with Private Lending

Did you know that Costa Rica’s real estate market has seen property prices rise by 5-10% annually? This growth is driven by a booming tourism industry and a thriving expat community. For those looking to capitalize on this trend, tailored financing solutions can make all the difference.

GAP Investments offers flexible loan options ranging from $50,000 to over $3,000,000. With competitive interest rates and terms from six months to three years, these solutions are designed to meet diverse investment needs. The approval process is quick, taking just 7 to 10 business days.

Safety is a priority, with collateral-backed lending and strict Loan-to-Value (LTV) ratios ensuring secure transactions. This approach minimizes risk while maximizing returns. Whether you’re new to the estate market or a seasoned investor, Costa Rica real estate presents a unique opportunity for growth.

Overview of Costa Rica’s Vibrant Real Estate Market

Costa Rica’s real estate market is thriving, driven by a mix of tourism and economic growth. The country’s appeal as a top travel destination and its welcoming environment for expats have created a robust demand for properties. This demand is further supported by strong government policies and a growing economy.

Market Trends and Economic Growth

The property sector has seen significant growth, with values rising steadily each year. Key factors include a 60% increase in GDP per capita and increased foreign investment. These trends make the market attractive for both residential and commercial projects.

Government support has also played a crucial role. Policies encouraging development and infrastructure improvements have enhanced accessibility to remote areas. This has opened up new opportunities for investors looking to capitalize on the market’s potential.

Impact of Tourism and Expanding Expat Community

Tourism is a major driver of the real estate boom. Recognized as a top destination, the country attracts millions of visitors annually. This has led to a surge in demand for vacation rentals and eco-friendly properties.

The growing expat community is another key factor. Many retirees and professionals are drawn to the country’s lower cost of living and high quality of life. This has fueled demand for homes in popular regions like the Central Valley and the Pacific coast.

With quick approval processes, often within 7 to 10 business days, investors can seize opportunities efficiently. The combination of strong economic growth and a vibrant property market makes Costa Rica a prime location for real estate investments.

Understanding “private lending for Costa Rica property investors”

For those looking to invest in real estate, private lending provides a unique alternative to traditional bank loans. This financing method is designed to meet the specific needs of investors, offering flexibility and speed that traditional options often lack.

Definition and Core Principles

Private lending involves securing funds from non-bank sources, such as specialized firms or individuals. The core principle is collateral-based financing, where the loan is backed by the property itself. This approach minimizes risk for the lender while providing investors with access to capital.

Risk management is a key aspect of private lending. Strict Loan-to-Value (LTV) ratios ensure that the loan amount does not exceed a certain percentage of the property’s value. This safeguards both parties and enhances investor confidence.

Comparing Private Lending with Traditional Loans

Private lending stands out for its flexibility and speed. Unlike traditional bank loans, which can take weeks or months to approve, private lenders often process applications in just 7 to 10 business days. This quick turnaround is ideal for investors looking to seize time-sensitive opportunities.

Another advantage is the tailored solutions offered by private lenders. Whether it’s a short-term loan for a renovation project or a larger investment in a commercial estate, the terms can be customized to fit the specific needs of the investor.

Additionally, private lending is asset-backed, meaning the property itself serves as collateral. This reduces the need for extensive credit checks and makes the process more accessible for a wider range of investors.

Key Features and Benefits of GAP Investments Financing

GAP Investments offers tailored financing solutions designed to meet the diverse needs of real estate projects. With competitive rates and flexible terms, these options provide a reliable way to fund investments efficiently.

Competitive Rates and Loan Amounts

One of the standout features of GAP Investments is its competitive interest rates, ranging from 12% to 18%. These rates are often more favorable compared to traditional banking options, making it an attractive choice for investors.

The loan amounts are equally impressive, starting at $50,000 and going up to over $3 million. This wide range ensures that both small and large-scale projects can be funded effectively.

Flexible Loan Terms and Rapid Approvals

Flexibility is another key benefit. Loan terms can be customized to fit specific needs, with options ranging from six months to three years. This adaptability allows investors to align their financing with their project timelines.

The approval process is quick, typically taking just 7 to 10 business days. This speed is crucial for investors looking to capitalize on time-sensitive opportunities in the market.

- Competitive interest rates from 12% to 18%.

- Loan amounts from $50,000 to over $3 million.

- Flexible terms ranging from six months to three years.

- Fast approval process completed in 7 to 10 business days.

These features make GAP Investments a trusted partner for those looking to maximize their returns and manage their investments effectively.

Tailored Financing Solutions for Diverse Real Estate Projects

Costa Rica’s real estate sector offers diverse opportunities for investors seeking tailored financing solutions. From luxury homes to eco-tourism developments, the right financing option can make all the difference in achieving success.

Residential, Commercial, and Eco-Tourism Projects

GAP Investments provides customized financing packages for a wide range of projects. Whether it’s a residential property, a commercial development, or an eco-tourism venture, each solution is designed to meet specific needs.

For residential projects, financing options include flexible terms and competitive rates. This allows investors to focus on building or renovating homes without financial strain. Commercial developments benefit from larger loan amounts, enabling businesses to expand or upgrade their facilities.

Eco-tourism projects are a growing trend in the region. With over 70% of properties being eco-friendly, financing options are tailored to support sustainable developments. This aligns with the increasing demand for environmentally conscious investments.

- Residential projects: Flexible terms and competitive rates.

- Commercial developments: Larger loan amounts for expansion.

- Eco-tourism ventures: Tailored solutions for sustainable growth.

These versatile financing options give investors a competitive chance to leverage the growing market. With loan amounts ranging from $50,000 to over $3 million and terms from six months to three years, GAP Investments ensures that every project is well-supported.

Prioritizing Safety and Risk Management in Investments

Safety is a cornerstone of successful real estate investments, especially in dynamic markets. GAP Investments ensures a secure environment by implementing robust risk management practices. These measures protect both lenders and borrowers, fostering confidence and long-term success.

Collateral-Based Lending and LTV Ratios

Collateral-based lending is a key feature of GAP Investments’ approach. This method uses the property itself as security, minimizing risk for all parties involved. By ensuring loans are backed by tangible assets, the likelihood of default is significantly reduced.

Loan-to-Value (LTV) ratios play a critical role in maintaining safety. GAP Investments adheres to a maximum LTV ratio of 50%, meaning the loan amount does not exceed half the property’s value. This conservative approach safeguards investments and ensures quick access to capital when needed.

Strict property appraisal processes further enhance security. Each property is carefully evaluated to determine its market value, ensuring sound lending decisions. This meticulous approach reduces the risk of overvaluation and protects both lenders and borrowers.

These risk management practices contribute to higher investor confidence. By prioritizing safety, GAP Investments creates a sustainable environment for growth. This focus on security fulfills the critical need for reliable financing in the real estate market.

Streamlined Processes and Fast Access to Capital

Efficiency and speed are critical in today’s competitive market, and GAP Investments delivers both with its streamlined processes. By minimizing bureaucratic hurdles, the company ensures that investors can access capital quickly and efficiently. This approach not only saves time but also enhances overall service delivery.

Efficient Application and Approval Process

GAP Investments simplifies the application process, making it easy for investors to secure financing. With a focus on property value rather than extensive credit checks, the approval process is completed in just 7 to 10 business days. This rapid turnaround is ideal for those looking to capitalize on timely market opportunities.

Lower closing costs are another advantage of this streamlined approach. By reducing unnecessary fees, GAP Investments ensures that more of the investor’s funds go directly into their projects. This efficiency supports quick decision-making and faster deployment of capital.

- Quick approvals within 7 to 10 business days.

- Reduced closing costs for greater financial flexibility.

- Operational efficiency that supports strategic investment moves.

The simplified process also aids in maximizing returns. By enabling fast access to financing, investors can seize opportunities that might otherwise be missed. This focus on speed and efficiency ensures that every investment has the potential to deliver strong results.

Maximizing Investment Returns through Strategic Private Lending

Strategic financing can significantly boost investment returns in dynamic markets. By leveraging tailored solutions, investors can achieve higher profitability and long-term growth. This section explores how competitive rates and market insights can drive success.

Analyzing Competitive Interest Rates

Interest rates play a crucial role in determining overall returns. GAP Investments offers rates starting at 12%, often more favorable than traditional bank options. This competitive edge allows investors to maximize their profits while minimizing costs.

Flexible terms further enhance the appeal. With options ranging from six months to three years, investors can align their financing with project timelines. This adaptability ensures that capital is used efficiently, leading to better outcomes.

Leveraging Market Opportunities for High ROI

Timely decisions are key to capitalizing on market opportunities. Private lending provides quick approvals, often within 7 to 10 business days. This speed enables investors to act swiftly and secure high-potential projects.

Maintaining favorable loan-to-value ratios is another critical factor. By adhering to a maximum ratio of 50%, GAP Investments ensures secure transactions. This approach minimizes risk while maximizing returns, making it a smart choice for investors.

- Competitive rates starting at 12% outperform traditional bank options.

- Flexible terms from six months to three years align with project needs.

- Quick approvals enable timely investment decisions.

- Favorable loan-to-value ratios reduce risk and enhance returns.

By combining these strategies, investors can achieve significant returns and sustainable growth. Private lending offers a unique advantage over traditional bank financing, making it a preferred choice for savvy investors.

Conclusion

Investing in real estate has never been more accessible, thanks to tailored financing solutions. The market’s steady growth, driven by tourism and economic development, offers significant potential for high returns. With competitive rates starting at 12% and flexible terms, these options cater to diverse project needs.

Quick approvals, often completed in just 7 to 10 business days, ensure investors can act swiftly on opportunities. This efficiency, combined with robust risk management practices, creates a secure pathway for growth. Collateral-based lending and strict LTV ratios further minimize risks, fostering confidence in every transaction.

GAP Investments stands out as a reliable partner, offering financing from $50,000 to over $3 million. Whether it’s residential, commercial, or eco-tourism projects, their solutions are designed to maximize returns. Explore these options today and seize the unique opportunity to grow your portfolio in this thriving market.