At the forefront of property financing in Costa Rica, GapInvestments.com stands as a beacon for…

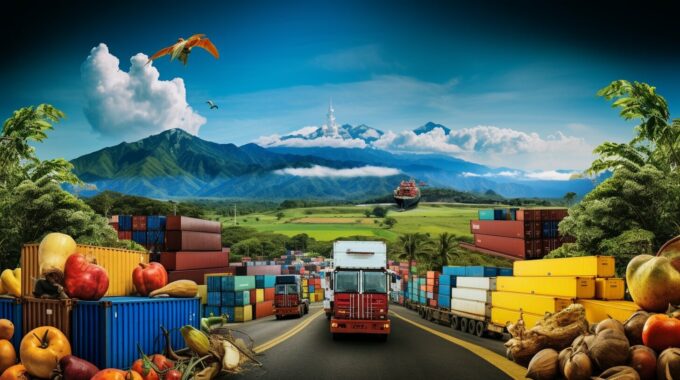

Understanding Costa Rica Import Duties: Complete Guide

Importing goods into Costa Rica involves navigating a complex system of import duties, customs regulations, and trade tariffs. These factors play a crucial role in determining the cost and process of importing goods into the country. Whether you are a business looking to expand your market or an individual looking to bring personal belongings or a vehicle into Costa Rica, understanding the import duties is essential.

- Importing goods into Costa Rica requires compliance with customs regulations and payment of import duties.

- Customs duties in Costa Rica range from 1 to 15 percent ad valorem.

- The Central America-Dominican Republic-United States Free Trade Agreement (CAFTA-DR) eliminated tariffs on 80 percent of U.S. exports to Costa Rica.

- New residents may be eligible for tax exemptions when importing vehicles, but certain requirements must be met.

- Having a comprehensive understanding of import duties in Costa Rica ensures a smooth and cost-effective importation process.

Now that you have a basic understanding of the import duties in Costa Rica, let’s dive deeper into the customs regulations, trade tariffs, and tax exemptions for importing goods and vehicles into the country.

Costa Rica Import Duties: Customs Regulations and Trade Tariffs

Understanding the customs regulations and trade tariffs in Costa Rica is crucial for businesses importing goods into the country. Navigating the complex system of import duties and customs regulations requires a comprehensive understanding of the process.

Customs duties in Costa Rica range from 1 to 15 percent ad valorem. The Central America-Dominican Republic-United States Free Trade Agreement (CAFTA-DR) has eliminated tariffs on 80 percent of U.S. exports, allowing most U.S. goods to enter Costa Rica duty-free. However, it’s important to note that a 13 percent value-added tax is imposed on most goods and services in Costa Rica.

Importing vehicles to Costa Rica can be expensive due to high taxes, but new residents may be eligible for tax exemptions. By obtaining a Costa Rica DIMEX card and depositing the vehicle at a customs warehouse, new residents can request a tax exemption. Once approved, the vehicle can be released from the warehouse without paying import duties. The duty rates for vehicles vary based on their age, with newer vehicles attracting lower rates.

By staying informed about the customs regulations, duty rates, and available tax exemptions, businesses can ensure a smooth and cost-effective importation process. It is recommended to seek assistance from Costa Rica Immigration Experts to navigate the complexities and facilitate a seamless transition.

Summary:

- Costa Rica’s import duties range from 1 to 15 percent ad valorem.

- The CAFTA-DR agreement has eliminated tariffs on 80 percent of U.S. exports to Costa Rica.

- A 13 percent value-added tax is imposed on most goods and services in Costa Rica.

- New residents may be eligible for tax exemptions when importing vehicles to Costa Rica.

- Having a comprehensive understanding of import duties is crucial for a smooth and cost-effective importation process.

| Import Duties | Customs Regulations | Tax Exemptions |

|---|---|---|

| 1-15% ad valorem | CAFTA-DR eliminated tariffs on 80% of U.S. exports | New residents can request tax exemptions for vehicles |

| 13% value-added tax | Compliance with customs regulations is essential | Obtain a Costa Rica DIMEX card for tax exemptions |

Importing Vehicles to Costa Rica: Tax Exemptions and Duty Rates

Importing vehicles to Costa Rica involves understanding tax exemptions and duty rates. The process can be expensive due to high taxes imposed on vehicles, but there are opportunities for new residents to take advantage of tax exemptions. To qualify for the exemption, new residents must obtain a Costa Rica DIMEX card and deposit the vehicle at a customs warehouse.

The exemption request is submitted online, and upon approval, the vehicle can be released from the warehouse without the need to pay import duties. This exemption not only helps reduce the financial burden of importing a vehicle but also simplifies the process for new residents who are already settling into their new lives in Costa Rica.

The duty rates for vehicles vary depending on their age. Generally, newer vehicles attract lower duty rates compared to older ones. It is important to consider the age of the vehicle and factor in the associated duty rates when planning to import a vehicle to Costa Rica.

Understanding the Process

When importing a vehicle to Costa Rica, it is crucial to understand the entire process, from tax exemptions to duty rates, in order to avoid any complications. By familiarizing yourself with the customs regulations and requirements, you can ensure a smoother and more cost-effective importation process.

| Vehicle Age | Duty Rate |

|---|---|

| Newer Vehicles | Lower duty rates |

| Older Vehicles | Higher duty rates |

By understanding the duty rates and tax exemptions, you can make informed decisions and plan your importation process accordingly. Consulting with experts in Costa Rica immigration can also provide valuable guidance and support, ensuring a seamless transition and compliance with all necessary procedures.

Ensuring a Smooth and Cost-Effective Importation Process

To ensure a smooth and cost-effective importation process in Costa Rica, it is crucial to have a comprehensive understanding of import duties and regulations. Navigating the complexities of customs procedures and tax requirements can be challenging, but with the assistance of Costa Rica Immigration Experts, you can streamline the process and avoid costly mistakes.

Costa Rica Immigration Experts specializes in providing comprehensive immigration and customs services to individuals and businesses. Their team of experienced professionals is well-versed in the intricacies of import duties, customs regulations, and tax exemptions in Costa Rica. They can guide you through the entire process, from understanding the applicable duty rates to completing the necessary paperwork.

One of the key advantages of working with Costa Rica Immigration Experts is their expertise in handling importation of vehicles. Importing vehicles to Costa Rica can be expensive due to high taxes, but new residents may be eligible for tax exemptions. Costa Rica Immigration Experts can help you navigate the requirements for obtaining a Costa Rica DIMEX card and guide you through the process of depositing your vehicle at a customs warehouse to qualify for the exemption.

By partnering with Costa Rica Immigration Experts, you can ensure a seamless transition and avoid unnecessary delays or complications. Their in-depth knowledge of import duties and regulations will help you minimize costs and maximize efficiency, allowing you to focus on your business or personal endeavors in Costa Rica.

Costa Rica Import Duties and Regulations – An Overview

Importing goods into Costa Rica involves navigating a complex system of import duties, customs regulations, and trade tariffs. Customs duties in Costa Rica range from 1 to 15 percent ad valorem. The Central America-Dominican Republic-United States Free Trade Agreement (CAFTA-DR) eliminated tariffs on 80 percent of U.S. exports, allowing most U.S. goods to enter Costa Rica duty-free. However, a 13 percent value-added tax is imposed on most goods and services in Costa Rica.

Importing vehicles to Costa Rica is expensive due to high taxes, but new residents may be eligible for tax exemptions. To take advantage of the tax exemption, new residents must obtain a Costa Rica DIMEX card and deposit the vehicle at a customs warehouse. The exemption request is submitted online, and upon approval, the vehicle can be released from the warehouse without paying import duties. The duty rates for vehicles vary depending on the age of the vehicle, with newer vehicles attracting lower rates.

Having a comprehensive understanding of import duties in Costa Rica is essential for a smooth and cost-effective importation process. By familiarizing yourself with the customs regulations, duty rates, and available tax exemptions, you can navigate the complexities of importing goods or vehicles into the country and ensure compliance with the necessary procedures.

| Goods | Customs Duty Range |

|---|---|

| 1 | 1% |

| 2 | 3% |

| 3 | 5% |

| 4 | 7% |

| 5 | 10% |

| 6 | 15% |

Contact Costa Rica Immigration Experts today to ensure a smooth and cost-effective importation process. Their team of professionals will guide you through the intricacies of import duties, customs regulations, and tax exemptions, allowing you to navigate the complexities with confidence.

In conclusion, navigating the complexities of import duties in Costa Rica requires a thorough understanding of customs regulations, duty rates, and available tax exemptions. By equipping oneself with this knowledge, businesses can successfully import goods and vehicles into Costa Rica while complying with the necessary procedures.

Importing goods into Costa Rica involves the careful consideration of import duties, customs regulations, and trade tariffs. Customs duties in Costa Rica can range from 1 to 15 percent ad valorem, while a value-added tax of 13 percent is imposed on most goods and services. However, the Central America-Dominican Republic-United States Free Trade Agreement (CAFTA-DR) has eliminated tariffs on 80 percent of U.S. exports, allowing for duty-free entry of most U.S. goods.

Importing vehicles to Costa Rica can be costly due to high taxes, but new residents may be eligible for tax exemptions. To take advantage of this exemption, new residents must obtain a Costa Rica DIMEX card and deposit the vehicle at a customs warehouse. By submitting an exemption request online and receiving approval, the vehicle can be released from the warehouse without paying import duties. The duty rates for vehicles vary based on their age, with newer vehicles typically attracting lower rates.

Having a comprehensive understanding of import duties in Costa Rica is crucial for a smooth and cost-effective importation process. By familiarizing oneself with customs regulations, duty rates, and available tax exemptions, businesses can navigate the complexities of importing goods and vehicles into the country while ensuring compliance with the necessary procedures.

FAQ

Q: What are the import duties in Costa Rica?

A: Import duties in Costa Rica range from 1 to 15 percent ad valorem. However, the Central America-Dominican Republic-United States Free Trade Agreement (CAFTA-DR) has eliminated tariffs on 80 percent of U.S. exports, allowing most U.S. goods to enter Costa Rica duty-free.

Q: Is there a value-added tax on imported goods in Costa Rica?

A: Yes, a 13 percent value-added tax is imposed on most goods and services in Costa Rica.

Q: How can I import a vehicle to Costa Rica?

A: Importing vehicles to Costa Rica is expensive due to high taxes. However, new residents may be eligible for tax exemptions. To take advantage of the tax exemption, new residents must obtain a Costa Rica DIMEX card and deposit the vehicle at a customs warehouse. The exemption request is submitted online, and upon approval, the vehicle can be released from the warehouse without paying import duties. Duty rates for vehicles vary depending on the age of the vehicle, with newer vehicles attracting lower rates.

Q: What should I do to ensure a smooth importation process in Costa Rica?

A: It is crucial to have a comprehensive understanding of import duties in Costa Rica. Familiarize yourself with customs regulations, duty rates, and available tax exemptions to navigate the complexities of importing goods or vehicles into the country and ensure compliance with necessary procedures.