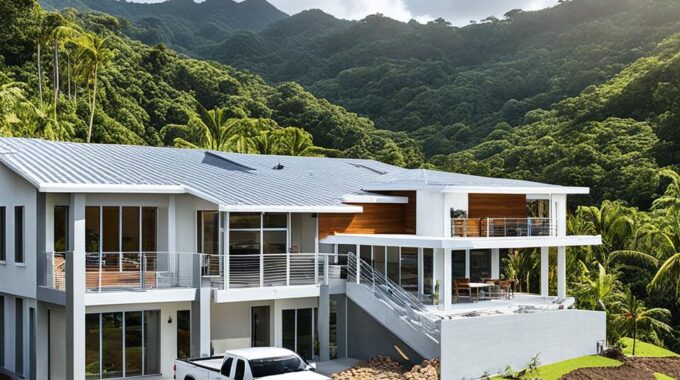

GAP Investments Lender Partnerships in Costa Rica: A Comprehensive Guide for Institutional Investors

Costa Rica has emerged as one of Latin America's most attractive markets for real estate…

Are you a real estate investor or homeowner in Costa Rica seeking funds for renovations? Choose GAP Equity Loans. They specialize in hard money loans for the Costa Rican market. Their loans vary from $50,000 to more than $3,000,000 USD. They have competitive rates starting at 12%.

Planning to fix and flip? Building a new structure? Or a big renovation project? GAP Equity Loans is here to help. They provide quick approval, usually 7-10 business days. This speed ensures you can grab opportunities in Costa Rica’s hot real estate market quickly.

In Costa Rica, the real estate scene is always changing. Here, hard money loans are becoming more popular. They are a great option for investors, builders, and homeowners. Unlike regular loans, they use the property as security. This makes it easier for people to get money fast for their real estate projects.

Hard money loans look at the property’s value, not just the borrower’s credit. This is different from traditional loans. Traditional loans mainly consider the borrower’s credit and income. Hard money loans care more about the property’s worth and how much the borrower has already invested. This makes getting money for real estate projects faster and simpler.

Hard money loans bring a lot of benefits in Costa Rica, especially for renovations. They provide money quickly, usually in 10 to 15 days. The loan terms are also flexible, from 3 to 36 months. Plus, they don’t rely heavily on the borrower’s credit score. This makes them a good choice for those wanting to fix up properties.

Being able to get money fast and the flexibility of these loans are a huge help. They help people take advantage of Costa Rica’s growing real estate market. With hard money loans, borrowers can start projects and make investments more easily.

GAP Equity Loans offers hard money loans in Costa Rica, perfect for property renovation. These loans are great for any project, big or small. They help with making a vacation home nicer or doing a full rehab on an investment. GAP Equity Loans looks at the property value, not just the borrower’s credit, making funding quick and terms flexible for people and homes in Costa Rica.

Looking to fix and flip? Or do you need funds for a big construction project? GAP Equity Loans is here to help with Costa Rica property renovations. We offer competitive rates from 12% and LTV ratios up to 50%. This makes it easier to get the financing you need to make your dreams a reality.

With GAP Equity Loans, use our Costa Rican real estate expertise for big returns. We make getting your project funded easier. Our team will assist you every step of the way, from the application to the final renovation.

In Costa Rica, LTV is key for hard money loans. It shows how much loan you get against the property’s value. At GAP Equity Loans, we value LTV’s role in your real estate goals or renovations.

The LTV ratio compares the loan amount to the property’s worth. A lower LTV means better loan terms, like cheaper interest rates. The property’s bigger worth than the loan reduces risk for the lender.

With us, you can get up to 50% LTV for Costa Rica property loans. So, borrowers can use a big part of the property value for updates. This option helps investors and homeowners get the cash they need for Costa Rica’s real estate growth.

Getting a hard money loan from GAP Equity Loans in Costa Rica is simple. You need to share details about the property. This includes its location, pictures, and its legal papers.

GAP Equity Loans will then visit the site and check the legal documents. They do this to review your application for the hard money loan fast.

GAP Equity Loans asks for a lot of information for a hard money loan. You must detail the property, its legality, and your ownership. They review this to be sure the property is a good choice for a loan.

They look at things like taxes and any other loans on the property. This is to make sure your Costa Rica property financing is safe and right.

GAP Equity Loans is quick to approve loans. Usually, you can get the money in 7 to 10 days. This is great for those looking at renovation financing or bridge loans. In Costa Rica’s fast real estate scene, quick funding makes a huge difference.

At GAP Equity Loans, our goal is to help you with hard money loans in Costa Rica. We offer competitive interest rates starting at 12%. You’ll find flexible loan terms, from 6 months to 3 years. This is perfect for both real estate investors and homeowners. Our loans suit projects like fix-and-flip, renovations, or bridge loans.

Our hard money loans come with interest rates between 12% and 16% per year. The actual rate depends on the loan-to-value ratio. This is great for quick real estate investments or renovations. We also let you choose loan terms from 6 months to 3 years. This flexibility helps you set up your project’s financing just right.

At GAP Equity Loans, we know a lot about Costa Rica’s real estate. Our experience comes from helping investors, builders, and homeowners with financing. Our expert team will guide you through the hard money loan process. We make sure your financing works well with the local market’s needs.

Working with us means getting personalized and attentive service. Our team will really listen to your financial needs. Whether you need loans for investment properties, renovations, or bridge projects, we’ve got you covered. We offer advice and support all the way through your loan. This helps make your real estate projects in Costa Rica successful.

At GAP Equity Loans, we know hard money loans are key for both real estate investors and homeowners. They help make successful property renovations in Costa Rica happen. These loans fit various project sizes, from small fix and flip plans to big construction and rehabilitation efforts.

Are you working on a small renovation or a huge construction project? Our hard money loans offer the funds to make your dream a reality. We provide loans from $50,000 to more than $3,000,000 USD for your Costa Rica real estate ventures.

With our hard money loans, clients can tailor strategies to boost their investments. Costa Rica’s real estate market presents many opportunities. Our clients use various real estate plans, from simple fix and flip jobs to long-term property makeovers. They all enjoy low interest rates and flexible terms.

GAP Equity Loans is dedicated to helping clients see and grab opportunities. We offer unique hard money loan solutions. These help our borrowers make the most of Costa Rica’s exciting real estate scene.

Costa Rica’s real estate market is growing fast. This means people need new, creative ways to finance their investments. One trend is alternative lending and hard money loans. These are changing how real estate projects get funded in the country.

GAP Equity Loans is a key player in this changing field. They offer private money loans designed for real estate investors and developers. Their competitive hard money loans help the real estate market in Costa Rica grow and develop.

In Costa Rica, private lenders have hard money loans for those who can’t get traditional bank loans. These loans have interest rates between 12% and 16% annually. They are a flexible way for investors and developers to take advantage of Costa Rica’s growing property scene.

In Costa Rica’s lively real estate world, GAP Equity Loans shine as a top choice for financing. They offer rates that range from 12% to 16%, considering how much the loan is against the property’s value (LTV ratio). Plus, you can pick a loan term of 6 months up to 3 years. GAP Equity Loans focus on the value of your property. This helps people grab chances, work on their homes, and hit their real estate goals.

The Costa Rican market is getting stronger, making options like hard money loans key for its success. With fast approval and funds most times in 7 to 10 business days, GAP Equity Loans lets people act quickly. They can take on urgent projects like fix and flip financing, construction loans, and rehab financing.

GAP Equity Loans’ know-how and custom help in Costa Rica give borrowers the chance to bring their renovation plans to life. This effort helps boost the country’s real estate scene. As more borrowers look for new ways to finance, GAP Equity Loans is ready to assist. They help investors and home owners increase their gains and shape Costa Rica’s real estate investment future.