At the forefront of property financing in Costa Rica, GapInvestments.com stands as a beacon for…

Complete Guide to Starting a Business in Costa Rica

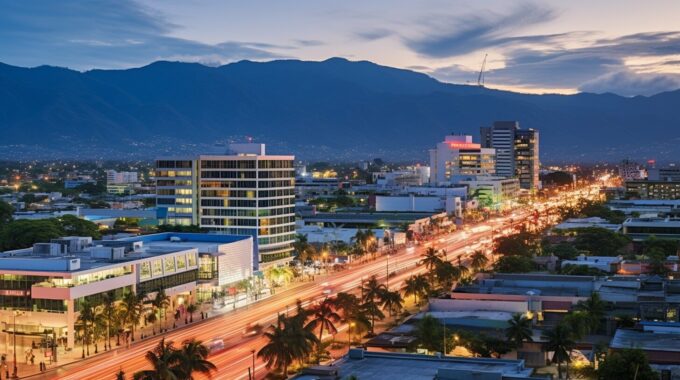

Starting a business in Costa Rica can be a lucrative endeavor for foreigners, but it’s important to understand the necessary steps and requirements for a successful business setup. The country offers a stable economy, a high quality of life, and a business-friendly environment. However, before diving into the Costa Rican market, it’s crucial to familiarize yourself with the visa requirements for working as a foreigner and the low wages in the country.

To start a business in Costa Rica, you’ll need to choose a suitable business structure that aligns with your goals and vision. Whether it’s a sole proprietorship, partnership, corporation, or limited liability company (LLC), selecting the right structure is essential for legal and operational purposes. Additionally, registering your business name is a crucial step in establishing your presence and protecting your brand.

Obtaining the necessary licenses and permits is another vital aspect of starting a business in Costa Rica. Depending on your industry and the nature of your business, there may be specific permits or licenses required. Complying with the tax regulations is also crucial. Corporate taxes and the Value Added Tax (VAT) are two key areas to consider, and understanding these regulations will help ensure your business operates legally and successfully.

Once your business is up and running, you’ll need to manage day-to-day activities, hire and manage employees, and navigate banking requirements. This entails developing efficient operational systems, recruiting the right talent, and establishing reliable banking relationships to facilitate smooth financial transactions.

By following the necessary steps and leveraging the resources available, you can successfully start and operate a business in Costa Rica. With its favorable business environment and opportunities, Costa Rica is an attractive destination for entrepreneurs looking to expand their ventures in Central America’s thriving market.

- Understand the visa requirements and low wages before starting a business in Costa Rica.

- Choose a suitable business structure and register your business name to establish your presence.

- Ensure you obtain the necessary licenses and permits specific to your industry.

- Comply with tax regulations, including corporate taxes and the Value Added Tax (VAT).

- Develop efficient operational systems, recruit the right talent, and establish reliable banking relationships.

Visa Requirements and Business Structure in Costa Rica

Before starting a business in Costa Rica, it’s essential to understand the visa requirements for foreigners and choose the appropriate business structure. As a foreign entrepreneur, you will need to obtain a residency visa to legally work and live in the country. There are several types of visas available, including the investor visa for those who plan to invest a significant amount of money in the country, the rentista visa for individuals with a steady income from abroad, and the work visa for those who have secured a job offer from a Costa Rican company. It’s important to consult with an immigration lawyer to determine the best visa option for your specific circumstances.

In addition to the visa requirements, you will also need to consider the different business structures available in Costa Rica. The most common types of business structures are sole proprietorship, partnership, and corporation. Each structure has its own advantages and disadvantages in terms of liability, taxation, and ease of operation. For example, a sole proprietorship is the easiest and least expensive to set up, but it also offers no protection of personal assets. On the other hand, a corporation provides limited liability protection, but it requires more complex administrative and legal procedures.

To register your business in Costa Rica, you will need to follow the required steps and provide the necessary documentation. This includes registering your business name with the National Registry, obtaining a taxpayer identification number, and registering with the Costa Rican Social Security System. It’s recommended to seek assistance from a local attorney or business consultant to ensure compliance with all legal requirements.

Once you have established your business and obtained the necessary permits and licenses, you can begin operating in Costa Rica. It’s important to familiarize yourself with the local business laws and regulations, including tax obligations. Costa Rica has a relatively low corporate tax rate of 30%, but it also has a number of other taxes and fees that may apply to your business, such as the Value Added Tax (VAT) and municipal taxes. It’s crucial to keep accurate financial records and file your tax returns on time to avoid penalties and legal issues.

| Visa Requirements | Business Structure | Business Registration | Taxes |

|---|---|---|---|

| Residency visa | Sole proprietorship | Register business name | Corporate tax |

| Investor visa | Partnership | Taxpayer identification number | Value Added Tax (VAT) |

| Rentista visa | Corporation | Register with Social Security System | Municipal taxes |

Licenses, Taxes, and Operations in Costa Rica

Once your business is registered, you’ll need to obtain the necessary licenses and permits, comply with tax regulations, and manage day-to-day operations to ensure a successful business venture in Costa Rica. Obtaining the right licenses and permits is crucial to operate legally and avoid any potential penalties. The specific licenses and permits required will depend on the nature of your business.

In Costa Rica, business permits are issued by various government agencies depending on the industry. For example, if you plan to open a restaurant, you’ll need to obtain a health permit from the Ministry of Health. Similarly, if you’re starting a tourism-related business, such as a hotel or travel agency, you’ll need permits from the Costa Rican Tourism Institute (ICT). It’s important to research and identify the relevant permits for your specific industry to ensure compliance.

When it comes to taxes, Costa Rica has a few different types that businesses must adhere to. One of the most important taxes is the corporate tax, which is typically 30% of your net income. Additionally, businesses are also subject to the Value Added Tax (VAT) of 13%, which is levied on most goods and services. It’s essential to work with a knowledgeable accountant or tax advisor to ensure you’re meeting all tax obligations and taking advantage of any available deductions or incentives.

Managing day-to-day operations involves several aspects, including hiring and managing employees, maintaining financial records, and complying with labor laws. Costa Rica has a strong labor force, and hiring employees can be a competitive advantage for your business. However, it’s important to familiarize yourself with the country’s labor laws to ensure you’re meeting all requirements, such as providing employee benefits and adhering to wage regulations.

Conclusion

Starting a business in Costa Rica offers numerous opportunities, but it requires careful planning, adherence to legal requirements, and a thorough understanding of the country’s business environment.

First and foremost, it is essential to understand the visa requirements for working as a foreigner in Costa Rica. While the country offers a stable economy and a high quality of life, it’s important to consider the low wages in the country, as this can impact your business operations.

When starting a business in Costa Rica, you will need to choose a suitable business structure and register your business name. This process involves obtaining the necessary licenses and permits, which are required to operate legally. It is crucial to comply with tax regulations, including corporate taxes and the Value Added Tax (VAT), to avoid any legal complications.

Once your business is up and running, you will need to manage day-to-day activities, including hiring and managing employees. Understanding the banking requirements in Costa Rica is also important to ensure smooth financial operations. By following these steps and leveraging the available resources, you can establish and operate a successful business in Costa Rica.

FAQ

Q: What are the visa requirements for working as a foreigner in Costa Rica?

A: To work as a foreigner in Costa Rica, you will need to obtain a work permit, which requires a job offer from a company registered in the country. The company will need to sponsor your work permit application, and you will likely need to provide documents such as your passport, a police record, and proof of educational qualifications.

Q: What business structures are available in Costa Rica?

A: In Costa Rica, you can choose from several business structures, including sole proprietorship, partnerships, corporations, and limited liability companies (LLCs). Each structure has its own set of legal requirements and implications, so it’s essential to consult with a legal professional to determine the best option for your business.

Q: What licenses and permits are required to operate a business in Costa Rica?

A: The licenses and permits you will need to operate a business in Costa Rica depend on the nature of your business activities. Common licenses and permits include a commercial license, health permit, environmental permit, and municipal permit. It’s important to research and understand the specific requirements for your industry and comply with all necessary regulations.

Q: What are the tax regulations for businesses in Costa Rica?

A: Businesses in Costa Rica are subject to corporate taxes, which are based on their net taxable income. Additionally, there is a Value Added Tax (VAT) of 13% on most goods and services. It’s crucial to understand and comply with the tax regulations to avoid any penalties or legal issues.

Q: How can I manage day-to-day operations and hire employees in Costa Rica?

A: Managing day-to-day operations in Costa Rica involves understanding the local labor laws, which govern aspects such as working hours, minimum wages, and employee benefits. When hiring employees, you will need to adhere to the hiring process, including employment contracts and social security registration. It’s advisable to consult with a local HR professional or legal expert to ensure compliance with all labor regulations.

Q: What are the banking requirements for businesses in Costa Rica?

A: To operate a business in Costa Rica, you will need to open a bank account in a local bank. The requirements for opening a bank account may vary depending on the bank, but generally, you will need to provide identification documents, proof of address, and company registration documents. It’s important to research the different banking options available and choose a bank that meets your business needs.